Heat pumps are by far the most energy efficient way for you to heat and cool your home and to provide hot water. Federal, state and local incentives installing electric heat pumps have never been more generous and in combination may cover almost half your initial costs (see example below). Incentives include cash rebates and tax credits, as well as interest-free loans.

Commonwealth of Massachusetts and Local Programs

Mass Save® Incentives

Massachusetts law requires investor-owned utilities to use a portion of the rates you pay to fund the Mass Save program which can help you make your home more energy efficient. Under this program, you can qualify for residential heat pump rebates of up to $10,000 for air-source heat pumps (ASHPs) and $15,000 for ground-source heat pumps (GSHPs). Additional incentives are available for low- and moderate- income households.

To qualify for residential heat pump rebates, equipment must be installed by companies that are part of the Mass Save Heat Pump Installer Network (HPIN). For your convenience, many of these installers will include an estimate of the Mass Save rebates in their quotes, and some will even submit the rebate request on your behalf. However, you should always independently confirm your rebate amount by contacting Mass Save directly before you commit to an installation.

To ensure that you are getting equipment suited to New England’s cold climate, heat pumps must be ENERGY STAR® Cold Climate 6.1 certified to qualify for rebates. To be certain that your heat pump meets this standard, you should confirm yourself or ask your contractor to confirm that your heat pump is listed on the Mass Save Heat Pump Qualified Products List.

Municipal Light Plant (MLP) Customers

In order to qualify for Mass Save rebates, your electricity or natural gas must be supplied by an investor-owned utility such as Eversource or National Grid. If you do not heat with natural gas and live in a town served by a municipal lighting plant (MLP), you should visit your MLP’s website or contact them to learn about rebates they may offer. Some MLPs provide incentives that are comparable to MassSave rebates. To find the MLP in your area, see the Massachusetts Clean Energy Center’s map of Massachusetts Electricity Providers by Municipality

MA Sales Tax Exemption

According to the Mass.gov guide on Sales and Use Tax, sub-section Tax Exempt Items & Sales, under the topic Home & Household Items: Equipment directly related to solar, wind-powered or heat-pump systems (if the system is used as a primary or auxiliary power system for heating or supplying a taxpayer’s principal residence in Massachusetts)” is exempt from Massachusetts sales tax. In our experience, most Massachusetts HVAC installers do not charge sales tax, which is consistent with this exemption.

Financing – the Mass Save HEAT Loan Program

The Mass Save HEAT Loan Program provides 7-year, 0% interest loans of up to $50,000 for weatherization services, heat pumps, and electric panel upgrades.

Federal Tax Credits

Tax credits are subtracted from taxes you owe. Tax credits for heat pumps increased substantially in 2023 and will remain in effect for at least 10 years under tax changes mandated by the Inflation Reduction Act of 2022. Federal tax credits are based on the cost after state or local rebates, if any. Check with your tax preparer on available credits. See IRS FAQ’s on Clean Energy Credits

- ASHPs may qualify for a credit of 30% or a maximum of $2,000.

- HPWHs may qualify for a tax credit of 30% or a maximum of $2,000. This credit and the ASHP credit have a combined maximum of $2,000 in a single tax year.

- GSHPs may qualify for a tax credit of 30% of total installation cost with no maximum.

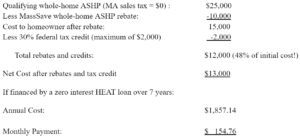

Heat Pump Example Illustrating Magnitude of Available Incentives

RESOURCES

Massachusetts

- Massachusetts Energy Rebates & Incentives

- Municipal Light Plants supported by Abode Energy Management

- Massachusetts Alternative Energy Portfolio Standards (APS)

- Mass.gov: Qualifying Ground Source Heat Pumps in the APS

Federal

- IRA Savings Calculator Learn which Inflation Reduction Act (IRA) benefits may be available to you with this online calculator.

- Rewiring America This site hosts the above linked calculator and includes other useful information about the IRA.

- Inflation Reduction Act Miniguide (pdf) (pg. 12-13)

- ACEEE: Home Energy Upgrade Incentives 2022

- America is All In: All in On Building Decarbonization in the Age of the Inflation Reduction Act

- What is in the bill? Explains the key programs in the IRA. It includes information on tax deductions and credits for EVs and residential solar and battery storage and more

- Guide to the Inflation Reduction Act Download an easy-to-read pdf guide to the IRA with a glossary of terms, detailed case studies and helpful tips on how to create an electrification plan

- Guide to Electrify Everything in Your Home is an extensive handbook that helps you create an electric plan for your home for a step-to-step process towards a net-zero future.

Note: The HeatSmart Alliance aims to provide its members and the public with accurate and up-to-date information, however we are not responsible for content outside of our website. Both federal and state incentives are subject to change. (Last Updated 4/12/2024)